Everything about Insurance: Necessary Insights for Savvy Consumers

Insurance plays a critical duty in monetary security and danger monitoring. Customers usually neglect the subtleties of different kinds of coverage, leading to misunderstandings and possible voids in security. Misunderstandings can cloud judgment, making it important to examine personal needs and alternatives critically. Understanding these components can considerably impact financial wellness. Lots of remain unaware of the approaches that can optimize their insurance options. What understandings could improve their method?

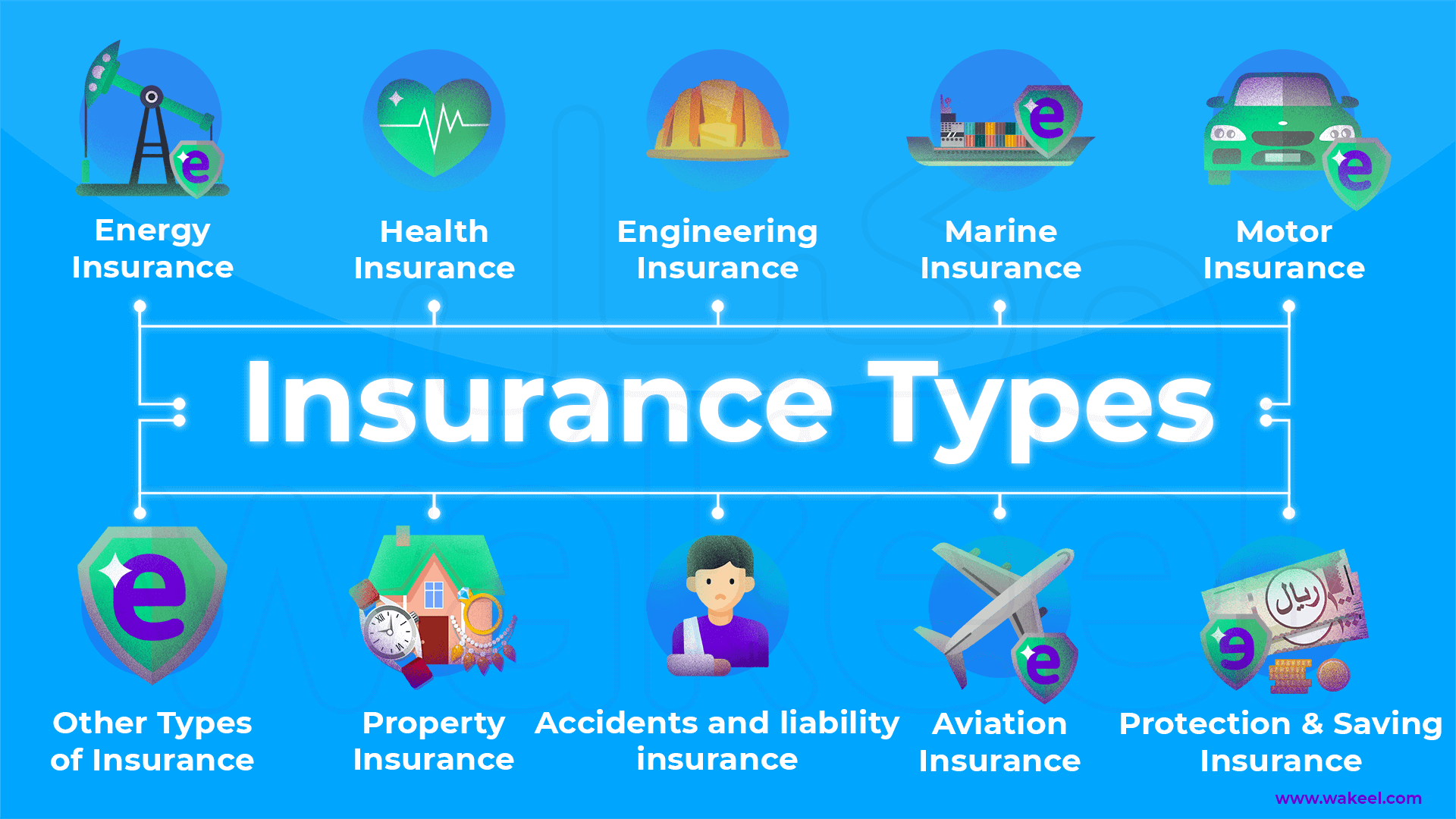

Recognizing Various Types of Insurance

What kinds of insurance should consumers consider to shield their properties and health? Numerous forms of insurance play a basic duty in protecting people and their properties. Health and wellness insurance is necessary for covering clinical expenses, making certain accessibility to necessary therapies without financial concern. Home owners insurance safeguards against problems to property and responsibility claims, while tenants insurance provides comparable insurance coverage for lessees. Automobile insurance is mandated in many locations and covers vehicle-related events, giving monetary safety and security in case of mishaps or burglary.

Life insurance policy works as a monetary safety web for dependents in case of a policyholder's fatality, aiding safeguard their future. Disability insurance is essential for revenue defense during extended illness or injury, allowing people to keep a standard of living. Umbrella insurance uses extra obligation coverage past typical plans, giving an additional layer of defense against unexpected conditions. Each kind of insurance addresses particular threats, making it essential for consumers to analyze their personal demands.

Usual Mistaken Beliefs Regarding Insurance

Exactly how often do consumers discover themselves misinformed regarding insurance? Several people harbor misunderstandings that can result in inadequate decisions. A prevalent myth is that all insurance plan are the same, which forgets essential differences in insurance coverage, exclusions, and premiums. One more common belief is that insurance is unneeded for young, healthy individuals; nevertheless, unforeseen events can take place at any age. Additionally, some customers think suing will instantly result in higher premiums, which is not constantly the case, as this differs by insurance company and private scenarios. In addition, numerous think that having insurance indicates they are totally secured against all prospective dangers, yet plans often have constraints and exemptions. These misconceptions can result in poor protection or monetary pressure. It is vital for consumers to inform themselves about insurance to make informed options and prevent risks that originate from misinterpreting their policies.

:max_bytes(150000):strip_icc()/how-does-insurance-sector-work.asp-FINAL-1ccff64db9f84b479921c47c008b08c6.png)

Evaluating Your Insurance Demands

When determining insurance needs, consumers typically wonder where to start (business insurance company abilene tx). An extensive analysis begins with examining personal conditions, including economic status, properties, and possible responsibilities. This entails recognizing what needs protection-- such as health, building, and income-- and understanding the dangers related to each

Next off, customers should consider their existing protection and any like this spaces that may exist. Assessing existing policies helps highlight locations that require additional defense or changes. Furthermore, life changes, such as marriage, home acquisitions, or parenthood, can considerably modify insurance demands.

Involving with insurance experts is also recommended, as they can give tailored suggestions based on specific scenarios. Ultimately, the objective is to develop an all-around insurance portfolio that lines up with personal objectives and provides satisfaction against unanticipated occasions. By taking these actions, customers can establish they are properly safeguarded without exhausting their funds.

Tips for Selecting the Right Insurance Coverage

Selecting the right insurance coverage can commonly really feel overwhelming, yet comprehending vital aspects can streamline the procedure. Customers should start by reviewing their specific needs, thinking about elements like personal assets, wellness condition, and way of living. It is vital to study various kinds of coverage offered, such as liability, all-inclusive, or crash, ensuring that each choice aligns with private circumstances.

Rate comparisons among different insurance service providers can reveal significant distinctions in costs and protection limits. Looking for quotes from multiple insurance firms can assist identify the very best value. Furthermore, customers must assess plan terms closely, taking notice of exemptions and deductibles, as these components can impact total defense.

Consulting with an insurance policy representative can offer customized understandings, ensuring that people are not overlooking crucial components. Ultimately, putting in the time to examine alternatives thoroughly brings about informed choices, providing comfort and ideal insurance coverage tailored to one's distinct scenario.

The Significance of Frequently Evaluating Your Policies

Routinely examining insurance plan is essential for keeping adequate coverage as individual situations and market problems transform. business insurance agent abilene tx. Life occasions such as marital relationship, the birth of a youngster, or adjustments in employment can greatly affect coverage demands. In addition, changes in the market, such as rises in costs or brand-new policy offerings, may provide far better options

Customers should establish a schedule, preferably every year, to assess their policies. This procedure permits individuals to determine gaps in insurance coverage, verify limitations suffice, and remove unnecessary plans that might no more advice offer their requirements. In addition, assessing policies can lead to potential savings, as customers might uncover price cuts or reduced premiums available with modifications.

Ultimately, positive testimonial of insurance policies equips consumers to make enlightened decisions, assuring their insurance coverage aligns with their current lifestyle and monetary scenario. This persistance not only enhances defense however likewise advertises monetary assurance.

Frequently Asked Concerns

Exactly How Can I Submit a Case With My Insurance Company?

To sue with an insurance service provider, one commonly needs to contact the company straight, offer required paperwork, and follow the certain procedures outlined in their plan. Timeliness and precision are crucial for effective claims processing.

What Factors Impact My Insurance Premiums?

Different aspects affect insurance costs, consisting of the insured individual's age, wellness status, location, type of insurance coverage, declares history, and credit rating rating. Insurance providers analyze these aspects to establish danger degrees and suitable premium prices.

Can I Adjustment My Coverage Mid-Policy Term?

Transforming coverage mid-policy term is typically possible - business insurance agent abilene tx. Insurance firms usually allow modifications, impacting costs accordingly. Insurance policy holders must consult their insurance supplier to comprehend certain terms, ramifications, and prospective costs linked with modifying their coverage during the plan period

What Should I Do if My Case Is Refuted?

Exist Price Cuts for Bundling Several Insurance Policies?

Lots of insurance companies supply discount rates for bundling numerous policies, such as see this site home and vehicle insurance. This practice can cause significant financial savings, motivating consumers to settle insurance coverage with a solitary insurance company for convenience and affordability.